HomeHong Kong

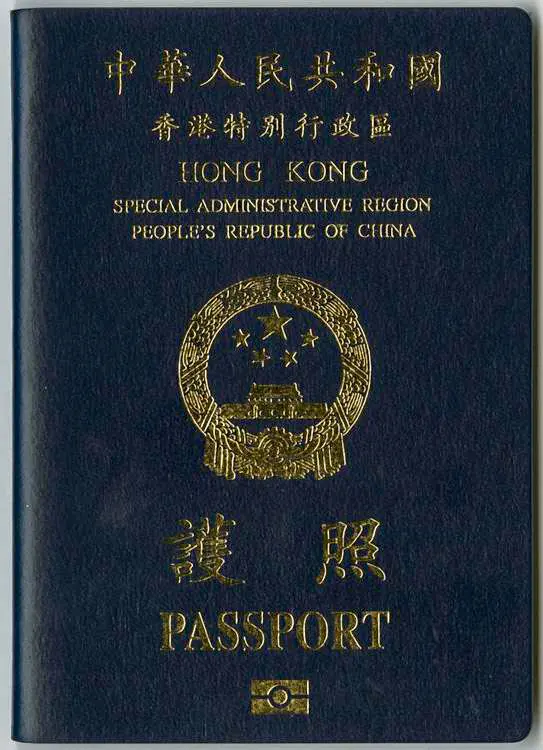

🇭🇰 Hong Kong

A financial hub in the heart of East Asia and a gateway to China.

Territorial tax system: only income generated within Hong Kong is taxable

Low income tax rates: 2-17% personal tax and 16.5% corporate tax

World-class banking system with 160+ licensed banks and strong privacy protections

Startup and crypto-friendly environment with clear regulatory framework

Hong Kong Citizenship and Naturalization

Grade:

A-Global Rank: 42

Dual Citizenship:No

Visa-free Access

150 out of 195 countries

Access to Major Destinations

- European Union

- United Kingdom

- Canada

- United States

- China

- Russia

- Japan

| Category | Details |

|---|---|

Citizenship by Descent |

|

Naturalizations |

|

Spouse Naturalization |

|

Birthright Citizenship |

|

Economic Citizenship (Investment) |

|

Other Provisions |

|

Citizenship by Exception |

|

Taxation Overview

Personal Tax Overview: Hong Kong 🇭🇰

Key information about personal taxation in Hong Kong

Taxation system

Territorial tax system

Personal Income Tax Rate (Up to)

17%

Tax Residency

Normal rule: 183 days

Special rule: No information

Special Tax Regime

No information

| From (HKD) | To (HKD) | Tax Rate |

|---|---|---|

| 0.01 | 50,000 | 2% |

| 50,000.01 | 100,000 | 6% |

| 100,000.01 | 150,000 | 10% |

| 150,000.01 | 200,000 | 14% |

| 200,000.01 | and above | 17% |

Dividend Tax

0%

Dividends are tax exempt.

Capital Gains Tax

0%

Capital Gains are tax exempt.

Property Rental Income

0%

For properties outside of HK the rental income is tax exempt.

Property Tax

Yes

Inheritance Tax

No

Wealth Tax

No

VAT

0%

CFC Laws

No

EXPLORE MORE OPTIONS