HomeSingapore

CHOOSE THE BEST RESIDENCY PROGRAM FOR YOU

Visa and residence permit options

BUSINESS FORMATION OPTIONS

Corporate Entities in Singapore

Compare the different types of business entities available for incorporation in Singapore.

Corporation

Singapore PTE LTD

Corporate Tax Rate

17%

Effective Tax Rate

17%

Tax Regime

Territorial Tax

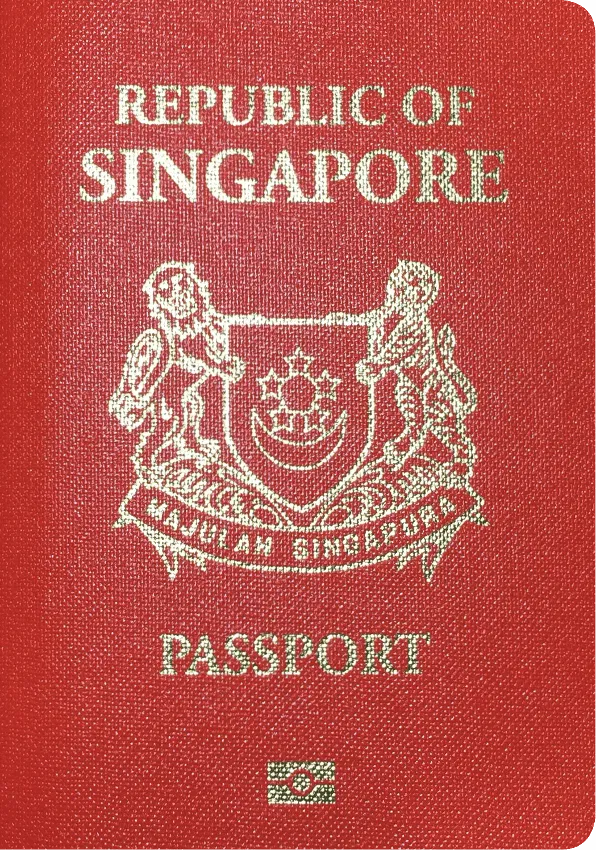

Singapore Citizenship and Naturalization

Grade:

A+Global Rank: 2

Dual Citizenship:No

Visa-free Access

164 out of 195 countries

Access to Major Destinations

- European Union

- United Kingdom

- Canada

- United States

- China

- Russia

- Japan

| Category | Details |

|---|---|

Citizenship by Descent |

|

Naturalizations |

|

Spouse Naturalization |

|

Birthright Citizenship |

|

Economic Citizenship (Investment) |

|

Other Provisions |

|

Citizenship by Exception |

|

Taxation Overview

Personal Tax Overview: Singapore 🇸🇬

Key information about personal taxation in Singapore

Taxation system

Territorial tax system

Personal Income Tax Rate (Up to)

24%

Tax Residency

Normal rule: 183 days

Special rule: No information

Special Tax Regime

No information

| From (SGD) | To (SGD) | Tax Rate |

|---|---|---|

| 0.01 | 20,000 | 0% |

| 20,000.01 | 30,000 | 2% |

| 30,000.01 | 40,000 | 3.5% |

| 40,000.01 | 80,000 | 7% |

| 80,000.01 | 120,000 | 11.5% |

| 120,000.01 | 160,000 | 15% |

| 160,000.01 | 200,000 | 18% |

| 200,000.01 | 240,000 | 19% |

| 240,000.01 | 280,000 | 19.5% |

| 280,000.01 | 320,000 | 20% |

| 320,000.01 | 500,000 | 22% |

| 500,000.01 | 1,000,000 | 23% |

| 1,000,000.01 | and above | 24% |

Dividend Tax

0%

Dividends are tax exempt.

Capital Gains Tax

0%

Capital gains are tax exempt in Singapore.

Property Rental Income

0%

Singapore properties are taxed at income tax level, and foreign properties are exempt from taxation.

Property Tax

Yes

Inheritance Tax

No

Wealth Tax

No

VAT

9%

CFC Laws

No

EXPLORE MORE OPTIONS